2024 Handbook of the International Code of Ethics for Professional Accountants

Including International Independence Standards

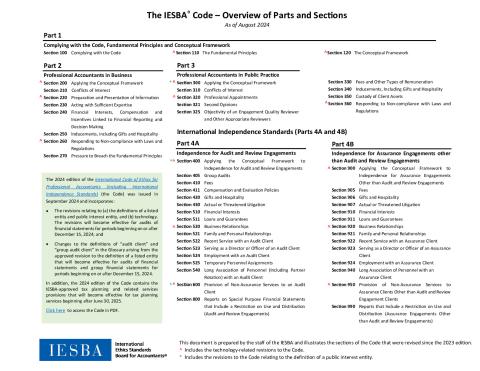

This handbook replaces the 2023 edition and incorporates the following:

- The revisions relating to the definition of a public interest entity which, among other matters, specifies a broader list of mandatory public interest entity categories, including a new category “publicly traded entity” to replace the category of “listed entity.”

- The revised public interest entity definition and related provisions will be effective for audits of financial statements for periods beginning on or after December 15, 2024.

- Changes to the definitions of “audit client” and “group audit client” in the Glossary arising from the approved revisions to the definitions of listed entity and public interest entity.

- The revised definitions will be effective for audits of financial statements and group financial statements for periods beginning on or after December 15, 2024.

- Technology-related provisions of the Code.

- The technology-related revisions to Parts 1 to 3 will be effective as of December 15, 2024.

- The technology-related revisions to Part 4A will be effective for audits and reviews of financial statements for periods beginning on or after December 15, 2024.

Early adoption of the revisions is encouraged.

The back of the 2024 Handbook contains the IESBA-approved revisions to the Code which are not yet effective. These revisions will become effective after June 2025 and include:

- Revisions to the Code addressing Tax Planning and Related Services.

Click here to learn more about the IESBA Code.

Reproducing and Translating the IESBA Handbook

To help adoption and implementation of the IESBA standards, stakeholders are invited to submit requests for permission to reproduce or translate the IESBA Handbook online via the Online Permissions Requests or Inquiries system on the IFAC website.

Copyright © 2025 The International Federation of Accountants (IFAC). All rights reserved.