High-quality internal and external reporting is critical for all organizations. High-quality reports promote better internal decision making and high-quality information is also integral to the successful management of any organization.

Therefore, it is clearly in organizations’ best interest, for their internal decisions and management issues as well as external stakeholder needs, to provide stakeholders with high-quality business reports. The most effective way to accomplish this is to implement effective reporting processes throughout an organization. When done correctly, effective reporting processes ensure that all internal and external stakeholders receive appropriate high-quality business reports in a timely fashion.

Professional accountants in business are often involved in the implementation—including design, planning, execution, audit, evaluation, and improvement—of their organizations’ reporting processes. The key issues professional accountants in business need to address when implementing effective reporting processes in their organization are discussed in the guidance.

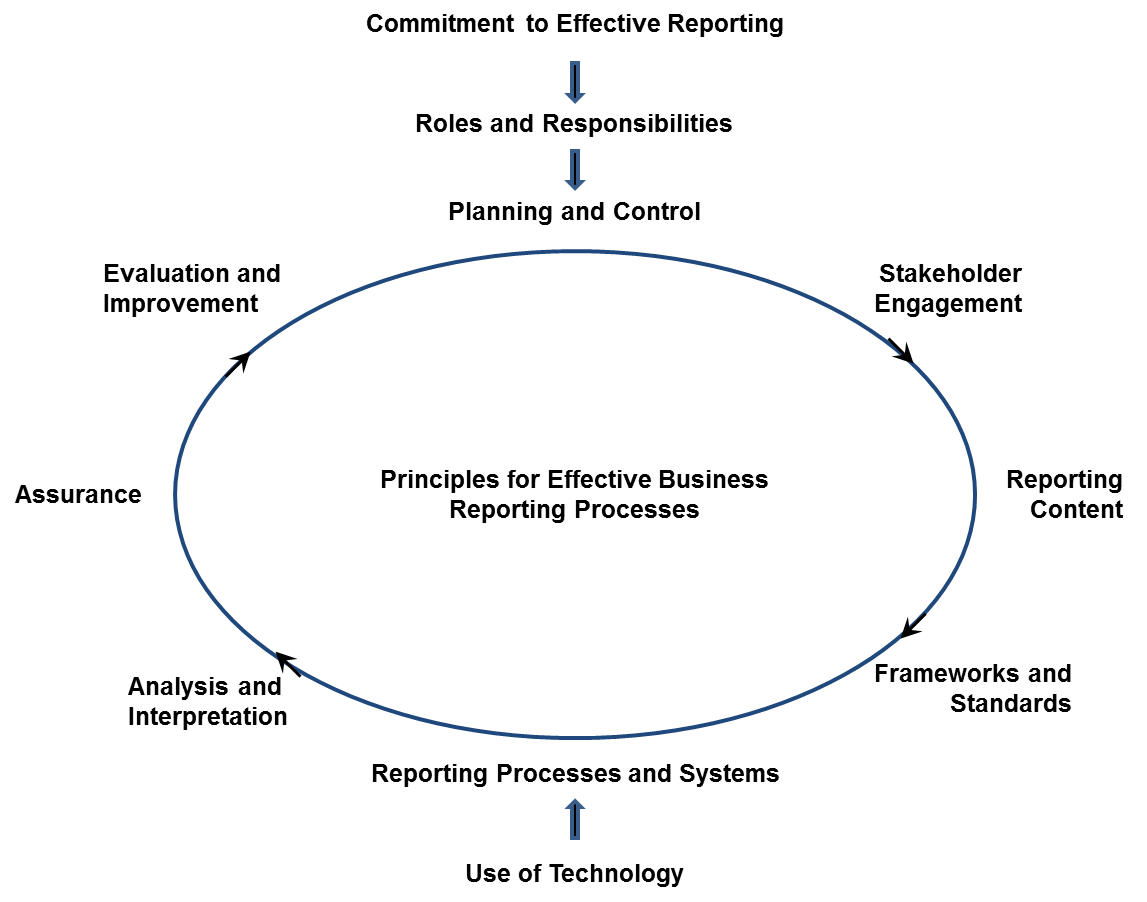

At the heart of the new guidance are 11 key principles for evaluating and improving business reporting processes (see below). These principles are complemented by practical guidance that outlines the critical arrangements that need to be in place for effective business reporting.

The guidance also includes a limited list of relevant resources from IFAC, its member bodies, and other relevant organizations. It can be downloaded free of charge from www.ifac.org/paib.

Key Principles for Effective Business Reporting Processes

These principles do not prescribe a specific approach but highlight a number of areas for consideration when implementing or improving business reporting processes.

A. Senior management should assume leadership for high-quality reports through effective reporting processes. The governing body should demonstrate commitment to high-quality reports and provide strategic input into, and oversight over, the organization’s reporting processes.

B. The organization should determine the various roles, responsibilities, and consequential capabilities in the reporting process, appoint the appropriate personnel, and coordinate collaboration among those involved in the reporting process.

C. The organization should develop and implement an effective planning and control cycle for its reporting processes in the context of, and in alignment with, its wider planning and control cycles.

D. To ensure the provision of high-quality information, the organization should regularly engage with its internal and external stakeholders and understand their information needs with regard to past, present, and future activities and results of the organization.

E. Based on the outcomes of its stakeholder engagement, and taking cost-benefit considerations into account, the organization should define the content to be included in its reports and also decide on the audience, layout, and timing of its reports.

F. The organization should have a process in place to ensure that the most appropriate reporting frameworks and standards are selected and that the requirements of those frameworks and standards are aligned with stakeholder information needs.

G. The organization should determine what information needs to be captured, processed, analyzed, and reported, and how to organize the information processes and related systems for effective reporting.

H. The organization should (a) identify, analyze, and select appropriate communications tools and (b) decide how to optimize distribution of the organization’s reporting information via the various communications channels.

I. The organization should ensure that reported information is sufficiently analyzed and interpreted before it is provided to internal and external stakeholders.

J. When obtaining internal or external assurance is not a matter of compliance, the organization should consider voluntary internal or external assurance on its reports and reporting processes.

K. The organization should regularly evaluate its reporting processes and systems in order to identify and carry out further improvements required for maintaining reporting effectiveness.

About International Good Practice Guidance

International Good Practice Guidance (IGPG) issued by the PAIB Committee cover areas of international and strategic importance in which professional accountants in business are likely to engage. In issuing principles-based guidance, IFAC seeks to foster a common and consistent approach to those aspects of the work of professional accountants in business not covered by international standards. IFAC seeks to clearly identify principles that are generally accepted internationally and applicable to organizations of all sizes in commerce, industry, education, and the public and not-for-profit sectors. Previously issued IGPGs are available on the IFAC website, including Preface to IFAC’s International Good Practice Guidance.

About the PAIB Committee

The PAIB Committee serves IFAC member bodies and professional accountants worldwide who work in commerce, industry, financial services, education, and the public and the not-for-profit sectors. Its aim is to promote and contribute to the value of professional accountants in business by increasing awareness of the important roles professional accountants play, supporting member bodies in enhancing the competence of their members, and facilitating the communication and sharing of good practices and ideas.