Len Jui, CPA, MBA, and Jessie Wong, CPA, Ph.D.

This article originally appeared in the China Accounting Journal, published by the Chinese Institute of CPAs.

When asked what accountants do, responses often mention roles such as tax agents and independent auditors. The functions performed by the vast number of professional accountants who work in businesses are often forgotten and not well understood.

What do the independent director, the internal auditor and the chief financial officer of companies all have in common? The individuals in these positions could all be professional accountants working in businesses. Besides these roles, professional accountants take on a vast array of other roles in businesses of all sorts including in the public sector, not-for-profit sector, regulatory or professional bodies, and academia. Their wide ranging work and experience find commonality in one aspect – their knowledge of accounting.

The importance of the role of professional accountants in business in ensuring the quality of financial reporting cannot be overly emphasized. Professional accountants in business often find themselves being at the frontline of safeguarding the integrity of financial reporting. Management is responsible for the financial information produced by the company. As such, professional accountants in businesses therefore have the task of defending the quality of financial reporting right at the source where the numbers and figures are produced!

Like their counterparts in taxation or auditing, professional accountants in business play important roles that contribute to the overall stability and progress of society. Without public understanding of all these diverging roles and responsibilities of different accounting specialists working in business, public perceptions of their value may be misinformed.

Roles of Professional Accountants in Business

A competent professional accountant in business is an invaluable asset to the company. These individuals employ an inquiring mind to their work founded on the basis of their knowledge of the company’s financials. Using their skills and intimate understanding of the company and the environment in which it operates, professional accountants in business ask challenging questions. Their training in accounting enables them to adopt a pragmatic and objective approach to solving issues. This is a valuable asset to management, particularly in small and medium enterprises where the professional accountants are often the only professionally qualified members of staff.

Accountancy professionals in business assist with corporate strategy, provide advice and help businesses to reduce costs, improve their top line and mitigate risks. As board directors, professional accountants in business represent the interest of the owners of the company (i.e., shareholders in a public company). Their roles ordinarily include: governing the organization (such as, approving annual budgets and accounting to the stakeholders for the company’s performance); appointing the chief executive; and determining management’s compensation. As chief financial officers, professional accountants have oversight over all matters relating to the company’s financial health. This includes creating and driving the strategic direction of the business to analyzing, creating and communicating financial information. As internal auditors, professional accountants provide independent assurance to management that the organization’s risk management, governance and internal control processes are operating effectively. They also offer advice on areas for enhancements. In the public sector, professional accountants in government shape fiscal policies that had far-reaching impacts on the lives of many. Accountants in academia are tasked with the important role of imparting the knowledge, skills and ethical underpinnings of the profession to the next generation.

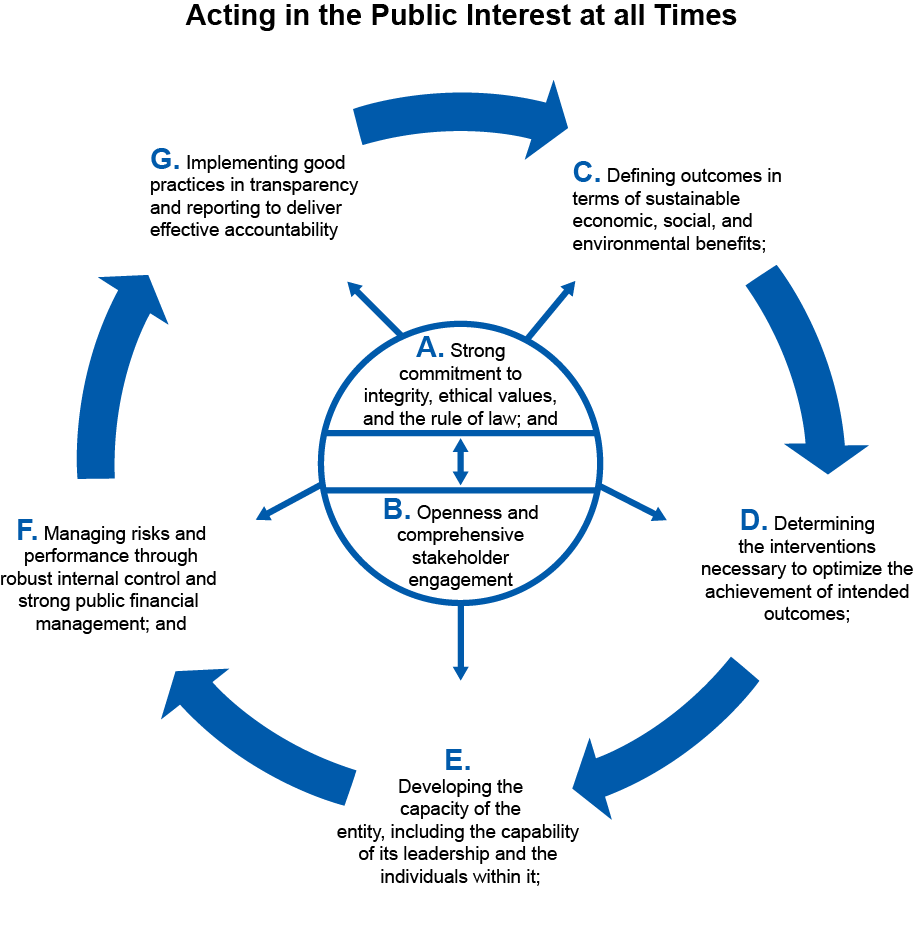

Protectors of Public Interest

A description of the multifaceted role of professional accountants in business is not complete without discussing the duty that the profession owes to the general public. As a profession that has been bestowed a privileged position in society, the accountancy profession as a whole deals with a wide range of issues that has a public interest angle. In the case of professional accountants in business, not only must they maintain high standards but they also have a key role to play in helping organizations to act ethically.

Closely link to the protection of public interest is the notion that public accountants need to be trusted to provide public value. Accountants will lose their legitimacy as protectors of public interest if there is no public trust. The accountancy profession has wide reach in society and in global capital markets. In the most basic way, confidence in the financial data produced by professionals in businesses forms the core of public trust and public value.

Competing Demands

Accountants often times face conflicts between upholding values central to their profession and the demands of the real world. Balancing these competing demands speaks to the very heart of being a professional in contrast to simply having a job or performing a function. Professionals are expected to exercise professional judgment in performing their roles so that when times get challenging, they do not undertake actions that will result in the profession losing the public’s trust as protectors of public interest.

Ethical codes for professional accountants globally compels professional accountants, regardless of the roles that they perform, to uphold values of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour. However, competing pressures can put professional accountants in challenging and often times difficult situations. These conflicts revolve around ethics, commercial pressures and the burden of regulation.

Situations may occur where professional accountants in businesses are expected to help the organization achieve certain financial outcomes. In some of these cases, the required action may risk compromising compliance with accounting and financial reporting rules. Professional accountants in businesses encounter tension in these situations. As an example, accountants in organizations may face pressures to account for inventories at higher values or select alternative accounting methods which are more financially favorable to the company. However, these actions may be contrary to what are allowable in the accounting standards or to what the professional accountant may feel comfortable with.

The Role of Professional Accounting Bodies in Promoting Professional Accountants

Professional accounting bodies globally have the important mandate of representing, promoting and enhancing the global accountancy profession. At the national level, the professional accounting body is the voice for the nation’s professional accountants; this includes all professional accountants both in practice and in business. Because they play different roles in the society, the overall status of the accountancy profession can only be strengthened when both professional accountants in practice and in business are well-perceived by society.

Because professional accountants in business are often the only members of staff who are professionally trained and qualified in accounting in the organization, they are more likely to rely on their professional accounting body for assistance in carrying out their work. They will look to the professional accounting body to provide them with the support and resources they need in doing their daily jobs and to keep their skills up-to-date. For example, professional accountants in business may look to their subject matter experts in the accounting body for advice on how to handle ethical dilemmas. They will also be dependent on their accounting body to provide continuous professional development training initiatives to keep their knowledge and skills current.

Evolving Role in an Evolving Environment

Like other professions, professional accountants are increasingly challenged to demonstrate their relevance in the capital market and their ability to evolve and face new challenges. Public expectations are high. The value of professional accountants will be measured by the extent to which they are perceived to be accountable not only to their own organizations but more importantly to the public.

Professional accountants in business are a key pillar in organizations helping to create and sustain value and growth. Their ability to continue to fulfill these roles in the face of constant environmental changes is vital to their continued relevance. Professional accountants in business are also the front runners when it comes to upholding the quality of financial reporting and providing the broader public with reliable financial information.

Professional accountants in business are an important critical mass in the global accountancy profession. The same applies at the national level. Public education on the diverse roles of professional accountants in business needs to be stepped up so as to increase the visibility of these roles. Professional accounting bodies also need to pay attention to their members in business and provide them with the support they need in order to succeed in their roles. Their voices also need to be represented. Achieving success on all these fronts will drive continued recognition by society of the value of professional accountants in business. This shapes the continued success of the accountancy profession as a whole.

About the authors:

- Len Jui CPA MBA, is KPMG Huazhen’s Partner – Head of Public Policy and Regulatory Affairs, Quality and Risk Management. He was formerly Associate Chief Accountant of the US Securities and Exchange Commission. Jui is a member of the China Auditing Standards Board and Technical Adviser to China’s Member of the Board of the International Federation of Accountants.

- Jessie Wong CPA PhD, is KPMG Huazhen’s Director – Public Policy and Regulatory Affairs, Quality and Risk Management. She was formerly Senior Technical Manager of the International Auditing and Assurance Standards Board and was also Policy Adviser of CPA Australia. Wong is a member of the Chinese Institute of Certified Public Accountants International Standards Taskforce.